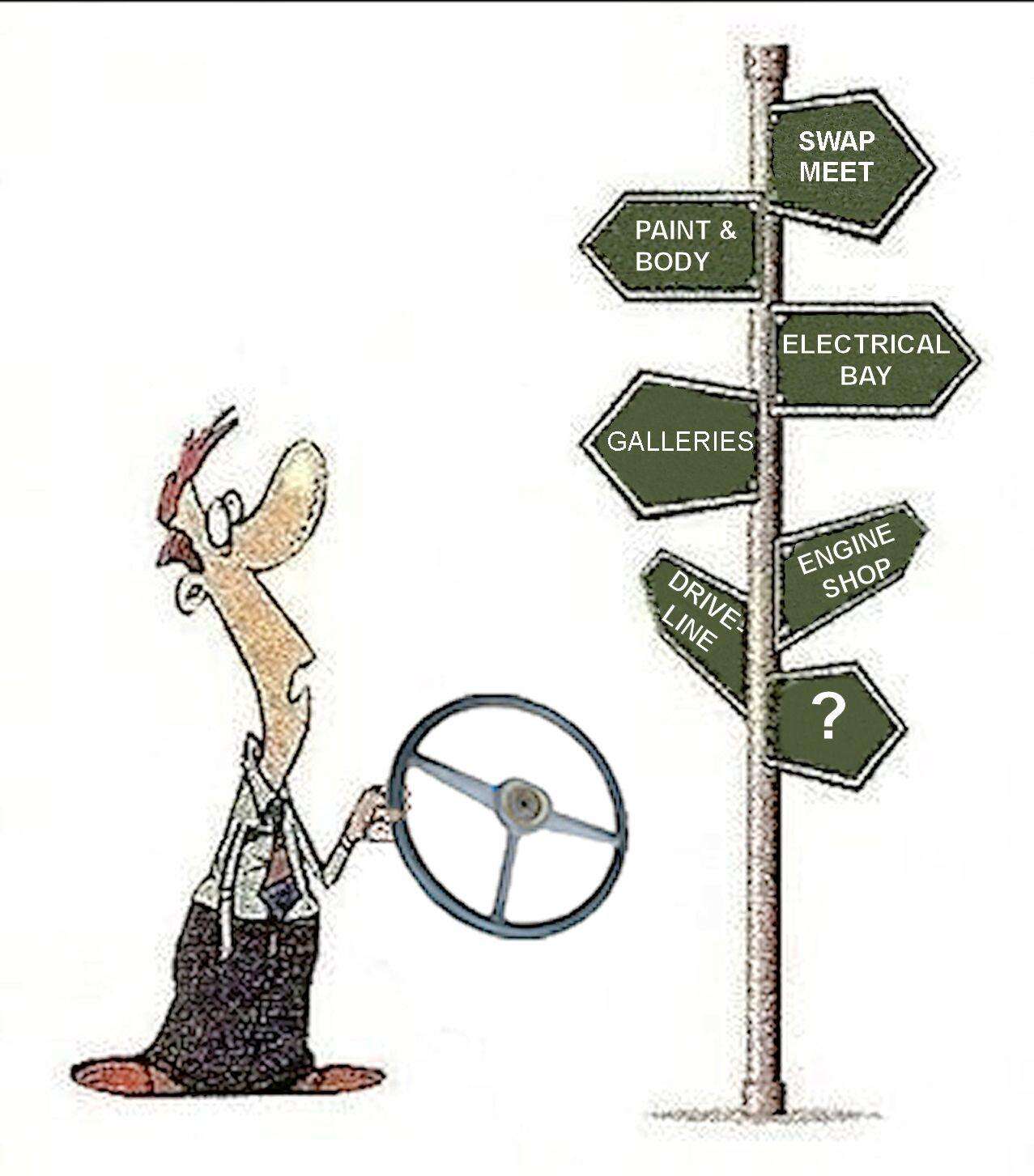

BUSY BOLTERS Are you one?  The Shop Area The Shop Area

continues to pull in the most views on the Stovebolt. In August alone there were over 22,000 views in those 13 forums.

| | Click on image for the lowdown.

====

| | | Forums66 Topics126,780 Posts1,039,292 Members48,100 | | Most Online2,175

Jul 21st, 2025 | | | | Joined: Aug 2013 Posts: 25 Wrench Fetcher | | Wrench Fetcher Joined: Aug 2013 Posts: 25 | Been wondering about this.

If you own a business and you purchased your classic truck to be used as either a shop truck, for advertising and promotion purposes, etc...

couldn't you then claim 100% depreciating deductible on the vehicle to include all repairs/restoration as tax write off for your business assuming you aren't using the vehicle for personal use?

any accountants or business owners in the house with some experience doing this or knowledge on the subject?

obviously the standard disclaimer applies... *contact your tax professional for specific advice*

| | | | | Joined: Feb 2002 Posts: 12,029 Cruising in the Passing Lane | | Cruising in the Passing Lane Joined: Feb 2002 Posts: 12,029 | yes, you should consult a tax accountant, you'd be adding the vehicle to your capital assets, better to keep it a personal possession and write off usage expenses like gas oil and tuneups

Bill | | | | | Joined: Sep 2010 Posts: 252 Shop Shark | | Shop Shark Joined: Sep 2010 Posts: 252 | I own a renovation (remodel) company just outside Toronto.

My '51 3100 is a company vehicle and I use it to visit jobs and pick up some material and deliver it to the site.

I write off all my expenses and depreciate the original capital cost of the truck.

Rules may be different in Canada but, I think we generally follow the same rules as you do in the US.

Here they even pay ALL my medical bills - and all my prescriptions now that I am old.

What a beautiful country we live in!!!

Sorry for the editorial :-) | | | | | Joined: Aug 2013 Posts: 568 Shop Shark | | Shop Shark Joined: Aug 2013 Posts: 568 | In the us you can write of mileage or fuel receipts plus maintenance. It's .55 a mile. The depreciable truck cost won't add up to much. I wrote off 22000 miles and I would recommend a fuel log and receipts. I'm not sure if Canada has an irs, but they can ruin you in a hurry here in the us. Try not raise any red flags with a ton of write-offs. My tax rate after write offs is 48%. You might have to have a fleet, more than 2 cars to get maintenance written off. I'm not positive.

8% state

15% federal

25% self-employed

No free health care here.

Last edited by Hollow65; 10/23/2013 4:19 AM.

I can explain it to you, I can't understand it for you.

| | | | | Joined: Nov 2002 Posts: 1,002 Shop Shark | | Shop Shark Joined: Nov 2002 Posts: 1,002 | I worked with a collector of Buick Skylarks compacts 1960-1963? He said he had setup a Roth account for the Buicks with his tax consultant. He was able to write off a portion of the expenses of the Buicks, like they were a business. I've not been able to find any info on how to do it, so I stick to cash.  Larry

I don't own a vehicle that isn't old enough to drink.

| | | | | Joined: Jan 2008 Posts: 4,903 'Bolter | | 'Bolter Joined: Jan 2008 Posts: 4,903 | Back in the 60's when I got my BBA in accounting, I was taught to take a deduction if it appears legitimate. Your chances of being audited are low and the IRS must prove intent to defraud in order to collect anything more than back taxes and interest. I purchase 10 year old trucks and completely rebuild them before I put them on the road. The rebuild normally costs more than the initial cost of the vehicle. I depreciate the the total cost just like I would any other business vehicle.

For personal transportation in my business, I trade for a new 3/4 ton every 3 years and expense every bit of it. I have been through several IRS audits. The main test is that I have another personal vehicle and that I insure the vehicle with a commercial policy. I don't use any of my jalopies for business purposes, but if I did, I would insure them under a commercial policy and depreciate just as I would any other asset.

Again, the most important test is that you insure it as a commercial vehicle and that you have a vehicle dedicated to personal use.

The initial cost plus repairs becomes the basis of the cost of the asset. | | | | | Joined: Aug 2013 Posts: 25 Wrench Fetcher | | Wrench Fetcher Joined: Aug 2013 Posts: 25 | good points crenwelge.

As a sole proprietor of a 'creative services' business I am considering using my panel truck for advertising, marketing and promotion as well as delivering final product if the job requires (eg signage, art shows, etc)

Since I have a personal vehicle I can only imagine a gray area being using the truck to drive to local car shows although that could be considered marketing and promotion since I would likely be promoting creative services wherever the vehicle goes.

Definition of creative services???

Metal sculpture, dimensional signage, graphic, web and logo design, halloween prop/mask creation... basically anything that requires visual design. Pretty wide range of services but seems to cover business use of the truck.

Again, just thinking about this now. Plan on talking to my tax guy. | | | | | Joined: Aug 2013 Posts: 568 Shop Shark | | Shop Shark Joined: Aug 2013 Posts: 568 | I'm no CPA and the irs scares the heck out of me. I too have a personal vehicle. My work truck is diesel. My cruiser is a 65 gas guzzler. My write offs are straight forward. I think I was able to write off the stickers on my truck for advertisement, just once though. It was only $500 or so either way. Born free and taxed to death.

Get them where ya can but be careful. Like Dennis miller says, "I'll send you a check once a year, and stay out of my life."

Last edited by Hollow65; 10/24/2013 2:47 AM.

I can explain it to you, I can't understand it for you.

| | | | | Joined: Dec 2008 Posts: 9 New Guy | | New Guy Joined: Dec 2008 Posts: 9 | The IRS and CRA (Cdn equivalent) will deny "restoration expense" unless you are a major corporation and it's a small part of a large business promotion budget

If you are a small business person and in the unlikely event they audit your claim they will ask to examine your INSURANCE POLICY. If your light commercial vehicle is part of your fleet and insured the same as your regular trucks you should have no problem

Howver,if your collector vehicle is insured by the likes of Grundy or Hagerty and you have agreed to restrictions on how & when it will be driven, your claim is likely to be denied (IMHO) | | |

|

|